Here's an excerpt from an article on Commodities & Gold:

As gold surged towards the $1900 per ounce price level over the past few months, there has been growing interest in gold as part of a well-diversified portfolio – and as a safe-haven investment. Indeed, the gold positions of large and well-respected institutional investors such as the University of Texas endowment, and hedge fund manager, Paulson & Company, have been in the news.

Interestingly, many of these headlines came around the time when gold was rallying towards its all-time highs in the $1900 range. We note that many of these large investors have already profited from their stakes in the precious metal. Since peaking at around $1900 per ounce in September 2011, gold sold off rapidly to $1550 within a few weeks. Gold has been consolidating mainly in the $1600-$1800 range since that time. Where will gold head from here? In this article, we look at gold – which stands at a crossroads, as we prepare for 2012.

...

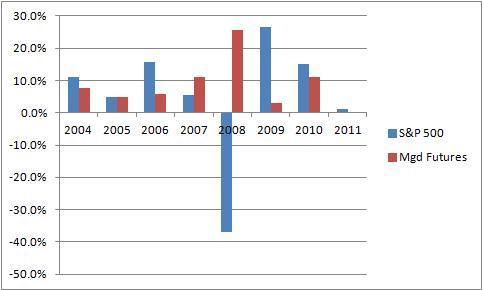

Our CTA’s proprietary trading models cover the gamut of time-frames, which include long-term and short-term trend-following. Briefly, our futures trading strategy can be described as:

- intermediate to long-term trend following, with

- pattern recognition and machine-learning components, and

- (short-term) risk management approaches that help set us apart from others.

In particular, some industry professionals like the fact that our pattern recognition and short-term risk management components have a slight mean-reversion flavor.

As intermediate-to-long-term futures traders, our outlook remains bullish, but the bullish case has started to crumble. As usual, we will follow our computer models and trading strategies to give us direction.

As our clients and investors know, we apply a “barbell” approach to help us maximize “forward information.” Systematic and computerized trading strategies keep us disciplined – and market action will dictate our positions.

Read more here:

Carlton Chin, CFA, is the portfolio manager for ADAMAH Capital, which specializes in Computer Aided Research & Advanced Technology (CARAT). He is a specialist in quantitative investment strategies, managed futures, alternative assets, global macro & strategic asset allocation. Carlton combines a CTA hedge fund background with portfolio optimization work for institutional investors. He founded Adamah with his long-time friend and associate, George Parr. Carlton has been quoted and featured in the Wall St. Journal, NY Times, MARhedge, Futures Magazine, and Financial Trader. He holds both undergraduate and graduate degrees from MIT.

AN INVESTMENT IN FUTURES CAN RESULT IN LOSSES.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.