INDIANAPOLIS – One turn. One stinkin’ turn.

JR Hildebrand made it through 799 of ’em without any trouble. As the young Californian approached that final left, all he had to do was keep his car off the wall, speed down the main straightaway and collect a win in the Indianapolis 500 on his very first try.

Instead, Hildebrand made the sort of colossal blunder that will forever link him to the Jean Van de Veldes of the sporting world.

...

Hildebrand was faced with a choice when he came up on another rookie, Charlie Kimball, going much slower as they approached the fourth turn.

The prudent thing would’ve been to back off and tuck in behind Kimball until they were on the main straightaway. Then Hildebrand could’ve gone on by to take the checkered flag.

Instead, showing his inexperience, Hildebrand decided to stay on the gas and go around on the outside. That put him into “the marbles,” the tiny particles of rubber that gather near the wall, making that part of the track especially slick.

He never had a chance.

“Is it a move that I would do again?” Hildebrand said. “No.”

_______________

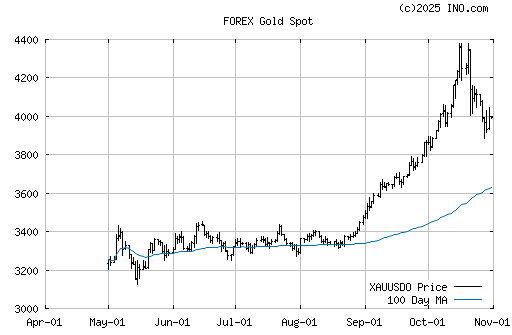

Similar analogies of experience, and weighing risk vs. returns can be made to investing and trading. We use computerized trading systems that take the emotions out of trading the financial markets. This keeps us disciplined and focused on idea generation and research.

Related info:

http://whowillwinthebiggame.blogspot.com/2011/05/indy-500-sport-psychology.html